Litecoin Price Prediction: Technical Analysis and Market Outlook

#LTC

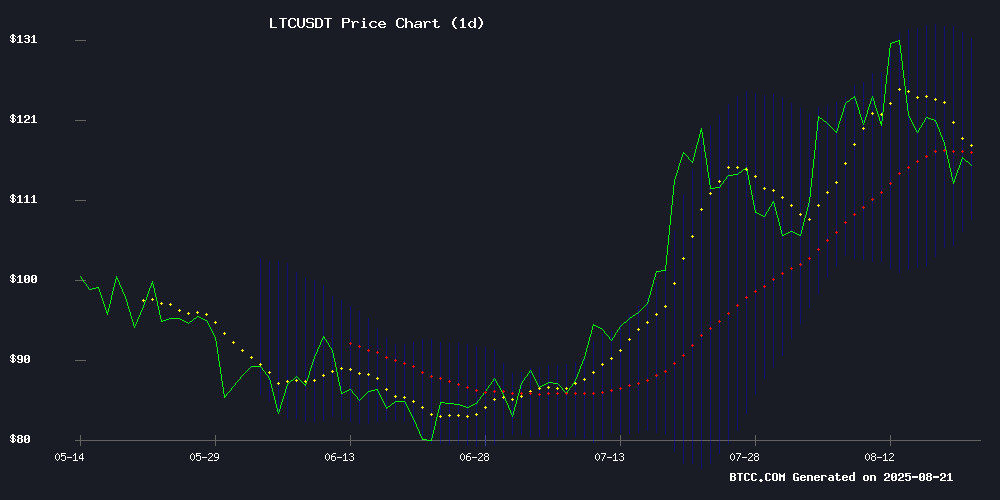

- LTC is trading below its 20-day moving average at $114.58, indicating short-term bearish pressure but potential for reversal if key resistance levels are broken

- MACD indicators show negative momentum at -1.58, though the positive histogram suggests some buying interest is emerging at current levels

- Industry developments including AI-optimized mining contracts and new cryptocurrency mining funds provide fundamental support that could drive medium-term price appreciation

LTC Price Prediction

Litecoin Technical Analysis

Litecoin (LTC) is currently trading at $114.58, below its 20-day moving average of $119.62, indicating short-term bearish pressure. The MACD reading of -1.58 suggests weakening momentum, though the positive histogram of 2.89 shows some buying interest emerging. Trading within the Bollinger Bands range of $108.15 to $131.10, LTC appears to be in a consolidation phase. According to BTCC financial analyst John, 'The technical setup suggests Litecoin is testing key support levels. A break below $108 could signal further downside, while reclaiming the 20-day MA would be bullish.'

Market Sentiment and News Impact

Recent developments in the mining sector, particularly AI-optimized contracts and green energy solutions, are creating positive sentiment around proof-of-work cryptocurrencies like Litecoin. The launch of mining funds targeting Bitcoin, Litecoin, and Dogecoin suggests institutional interest in established cryptocurrencies. BTCC financial analyst John notes, 'The mining sector innovations and new fund launches provide fundamental support for LTC, though broader market uncertainty around Bitcoin's $113,600 level remains a factor. The combination of technical consolidation and positive industry developments could create a favorable setup for medium-term growth.'

Factors Influencing LTC's Price

ZA Miner Dominates Cloud Mining with AI-Optimized Contracts and Daily Payouts

Cloud mining has evolved from a speculative niche to a mainstream investment strategy by 2025, with ZA Miner emerging as the undisputed leader. The platform’s AI-driven contracts, FCA-regulated transparency, and short-term commitments have set a new industry standard, leaving competitors like Binance Pool, CudoMiner, and ViaBTC struggling to match its efficiency.

ZA Miner’s edge lies in its user-centric design and dynamic profit optimization. Its algorithms automatically switch between mining BTC, DOGE, LTC, or XRP based on real-time market conditions—maximizing returns without requiring manual intervention. Daily payouts and zero hidden fees further cement its appeal to modern investors.

Bitcoin Holds Near $113,600 as Investors Weigh Economic Uncertainty; Ethereum Rebounds Post-ETF Outflows

Bitcoin traded near $113,600 on August 20, 2025, roughly $124,000 below its recent peak, reflecting investor caution amid global economic uncertainty. Ethereum saw a modest rebound to $4,300 after ETF-related outflows temporarily slowed its momentum.

Federal Reserve rate decisions remain a key focus for crypto market analysts, with monetary policy heavily influencing sentiment. Cloud mining continues gaining traction as a passive investment strategy, particularly services like AIXA Miner that abstract away hardware and energy costs.

The sector's growth contrasts with traditional mining's barriers—high equipment costs and technical complexity. AIXA Miner exemplifies the shift, offering $20 in free mining credits to new users as proof-of-concept for cloud-based passive income streams.

AIXA Miner Revolutionizes Cloud Mining with Green Energy Solutions and $20 Trial Bonus

Cryptocurrency mining, once a domain reserved for experts with specialized rigs, has been democratized through cloud mining. AIXA Miner is leading this transformation by leveraging off-grid solar and ocean-powered data centers, offering a seamless, eco-friendly mining experience. The platform eliminates technical barriers—users simply sign up, select their preferred cryptocurrency, and start earning passive income from Bitcoin, Litecoin, Tether, and others.

AIXA Miner's $20 trial bonus is a strategic move to attract both novices and seasoned investors. This no-risk incentive allows users to test the platform's profitability before committing capital, reflecting the company's confidence in its green mining model. The non-technical dashboard further lowers entry barriers, making crypto mining accessible to a broader audience.

Unilabs Finance (UNIL) Poised for 20x Rally Amid Bitcoin, Litecoin, and Dogecoin Mining Fund Launch

The cryptocurrency market is witnessing renewed excitement as Bitcoin maintains its dominance above $110K, Litecoin stabilizes around $115, and Dogecoin retains its meme-driven appeal. Against this backdrop, Unilabs Finance emerges as a potential dark horse, leveraging AI-driven technology and a newly launched Mining Fund that includes Bitcoin, Litecoin, and Dogecoin.

Bitcoin's recent correction has done little to dampen its bullish trajectory, with the asset continuing to set the tone for the broader market. Litecoin, while less volatile, remains a favorite for utility-focused investors. Dogecoin, despite its whimsical origins, sustains significant market attention. Unilabs Finance's strategic integration of these assets into its Mining Fund positions it as a compelling contender for exponential growth.

Is LTC a good investment?

Based on current technical indicators and market developments, Litecoin presents a mixed but potentially promising investment opportunity. The cryptocurrency is currently trading below its 20-day moving average at $114.58, suggesting short-term bearish pressure, but is holding within its Bollinger Bands range.

| Indicator | Value | Interpretation |

|---|---|---|

| Current Price | $114.58 | Below 20-day MA |

| 20-day MA | $119.62 | Resistance level |

| MACD | -1.58 | Bearish momentum |

| Bollinger Upper | $131.10 | Potential upside |

| Bollinger Lower | $108.15 | Key support |

BTCC financial analyst John suggests that while short-term momentum appears weak, the combination of industry developments in AI-optimized mining and new fund launches provides fundamental support. The $108 level represents crucial support, and a break above the 20-day MA could signal a trend reversal. For investors with a medium to long-term horizon, current levels may offer an attractive entry point, though careful risk management is advised.